Mark Saiger

Mr Happy!

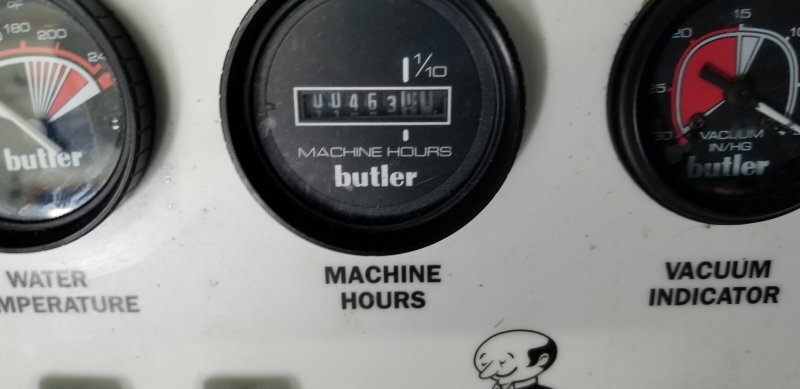

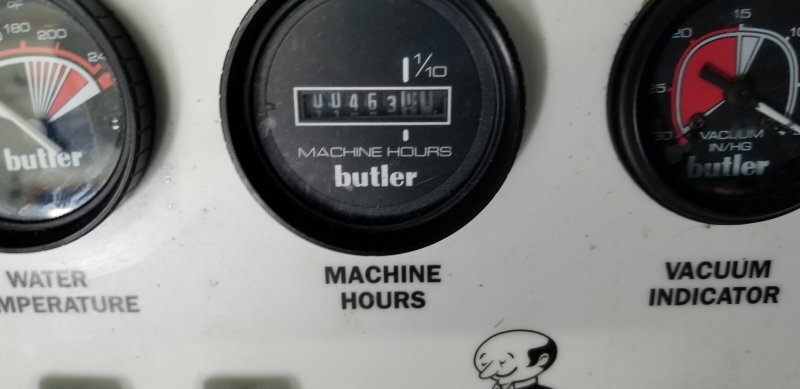

Just a reminder to write down your truckmount hours and van miles. There is an off road tax credit available in most states. We write off 2 gallons per hour. See info below and what tax forms to look at.

www.butlersystem.com

www.butlersystem.com

Fuel Consumption and Tax Savings Gas and Diesel Fueled Engines There is some important information regarding fuel consumption and possible tax savings that you may want to consider as a Butler System owner or when purchasing a Butler System and vehicle. Consumption: Fuel consumption with the Butler System in operation is estimated to be 1-1/4 to 1-3/4 gallons of fuel per hour. Consumption may vary from these estimates due to the quality of fuel, the blending of fuel in various regions of the country, summer and winter fuel blends, presence and/or volume of oxygenates and additives, fuel temperatures, octane/cetane ratings, altitude, climate, ambient temperature, condition of the vehicle's engine and the general condition of the Butler System. Fuel economy estimates for commercial vans and trucks are not provided by the manufacturers. However, customers who have purchased newer models are reporting considerable improvements in fuel consumption over previous model year(s). Fuel consumption is dependent, in addition to the variables listed above, on the payload, driving conditions, terrain and driving habits of the operator. Taxes: It is our understanding that the cost of fuel is a 100% tax deductible expense when a van or truck is used for business. Also, a federal fuel tax credit of $.184 per gallon for gasoline and $.243 for diesel fuel (refer to IRS Forms 4136, 8849, and Schedule 1) may be claimed when a commercial vehicle is used off-highway for business, such as, when the Butler System is in operation. A state fuel tax credit/deduction may also be claimed, in most states, when the vehicle is used off-highway for business. Information on federal fuel tax credits and refunds can be obtained from IRS Publication 510. Consult your state taxing authority for information regarding your particular state's relevant refunds, credits or deductions.* *The Butler Corporation recommends consulting a tax professional for the tax advantages that specifically pertain to you.

Tax Information - The Butler Corporation

Fuel Consumption and Tax Savings Gas and Diesel Fueled Engines There is some important information regarding fuel consumption and possible tax savings that you may want to consider as a Butler System owner or when purchasing a Butler System and vehicle. Consumption: Fuel consumption with the Butler System in operation is estimated to be 1-1/4 to 1-3/4 gallons of fuel per hour. Consumption may vary from these estimates due to the quality of fuel, the blending of fuel in various regions of the country, summer and winter fuel blends, presence and/or volume of oxygenates and additives, fuel temperatures, octane/cetane ratings, altitude, climate, ambient temperature, condition of the vehicle's engine and the general condition of the Butler System. Fuel economy estimates for commercial vans and trucks are not provided by the manufacturers. However, customers who have purchased newer models are reporting considerable improvements in fuel consumption over previous model year(s). Fuel consumption is dependent, in addition to the variables listed above, on the payload, driving conditions, terrain and driving habits of the operator. Taxes: It is our understanding that the cost of fuel is a 100% tax deductible expense when a van or truck is used for business. Also, a federal fuel tax credit of $.184 per gallon for gasoline and $.243 for diesel fuel (refer to IRS Forms 4136, 8849, and Schedule 1) may be claimed when a commercial vehicle is used off-highway for business, such as, when the Butler System is in operation. A state fuel tax credit/deduction may also be claimed, in most states, when the vehicle is used off-highway for business. Information on federal fuel tax credits and refunds can be obtained from IRS Publication 510. Consult your state taxing authority for information regarding your particular state's relevant refunds, credits or deductions.* *The Butler Corporation recommends consulting a tax professional for the tax advantages that specifically pertain to you.