F

FB19087

Guest

Economic Injury Disaster Loans and Loan Advance

Economic Injury Disaster Loans and Loan AdvanceTo apply for a COVID-19 Economic Injury Disaster Loan, click here.

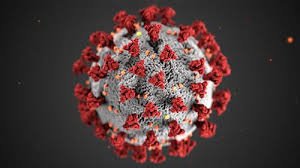

In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

COVID-19 ECONOMIC INJURY DISASTER LOAN

Manage your EIDL | U.S. Small Business Administration

Paycheck Protection Program

Paycheck Protection Program

An SBA loan that helps businesses keep their workforce employed during the Coronavirus (COVID-19) crisis.

www.sba.gov

other SBA programs:

State Unemployment Agencies (You may qualify for unemployment benefits now):

https://mikeysboard.com/threads/covid-19-resources-for-small-businesses.294932/post-4693339

Edit: State emergency/bridge loans (as I find them):

Florida

COVID-19 Resources for Florida Employers & Individuals

In coordination with state and federal partners, resources are available to assist employers and individuals impacted by the state’s efforts to mitigate the spread of COVID-19.

Last edited by a moderator: